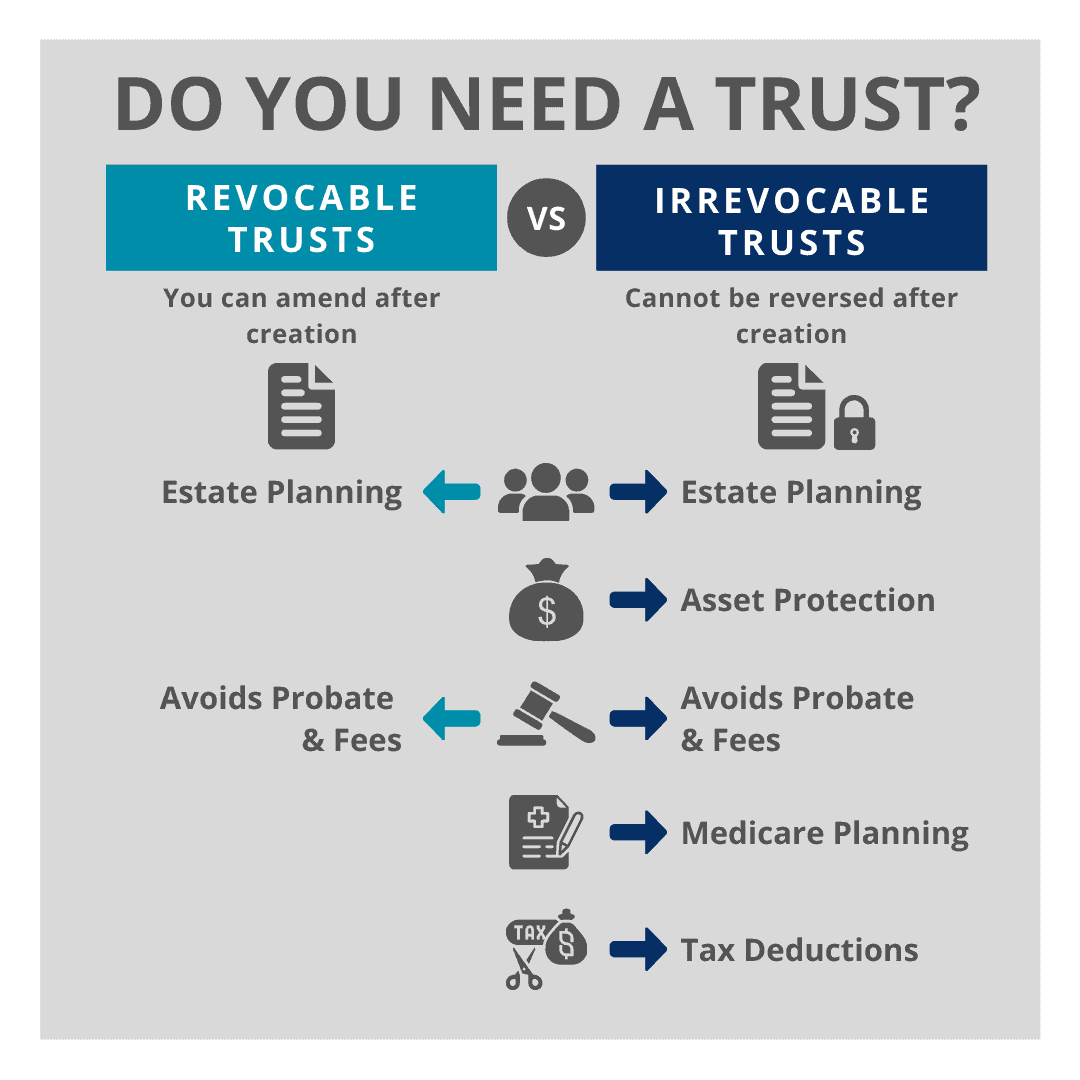

Many people think trusts are only for rich people, but that is certainly not the case. A trust is a protection vehicle for homes and other assets. Two of the most common trusts we create for clients, are the Revocable and Irrevocable Trust.

I can appreciate some people may get confused between choosing a Revocable Trust and an Irrevocable Trust, and often a confused mind takes no action.

How does a Trust work?

Think of a trust like a company. A person owns the company, and the company owns assets like furniture and computers. A trust is similar, but the only place a trust exists physically, is the paper used to document it. I write the trust agreement which my client signs. We add assets to that agreement by changing ownership of the assets, from the client individually to the trust.

There are three people involved in a trust. The Grantor is the person who creates the trust and puts their stuff into the trust, thereby changing ownership of their house or assets by putting them into the trust. The Trustee is the person in control of seeing that the trust is administered, and the Beneficiary has access to the assets in the trust.

Revocable Trust

The main reason people consider a revocable trust is to avoid the probate process. This trust is like an alternative to a will. When you die your assets are distributed by a will, and it goes through the probate process. A judge manages and administers this probate process to get your stuff to your beneficiaries. It takes around 14 months, and is often costly with the legal fees involved. It is also a matter of public record, so everyone knows who gets what asset.

A trust is administered around the lawyer’s conference table, rather than in the courthouse. It saves time and expense, which is why I prefer using trusts. They are also handy tools regarding second marriages and blended families. Moreover, they will ensure that the assets are distributed to those who are meant to receive them. They are also private, because only the trustee of the trust is aware of who gets what.

Irrevocable Trust

An Irrevocable trust is a document where you sign the agreement and you put your stuff into a trust, but you cannot revoke the document. The word ‘irrevocable’ scares people, because they think it is permanent, but there are aspects that aren’t permanent. Putting your assets into an irrevocable trust, means you are giving up access and the ability to personally own the assets. This also means that you can protect your assets from long term care expenses, because creditors have no access to the money or assets in your irrevocable trust. This ensures that your family gets your assets, rather than losing the assets to long term care expenses.

What is an Asset Protection Trust?

This type of irrevocable trust we refer to, is also known as an asset protection trust. When you put the assets in the trust, you leave it to the beneficiaries. More often that not, the beneficiaries are your kids, and they can access the money for you should it be necessary.

Come to Our Workshop

Maybe you are nearing retirement age and you want to learn more, to find out if trusts are right for you… if so, I suggest you check out the great resources available on our website. Visit https://sechlerlawfirm.com/workshops/ and register for one of our upcoming workshops. We help you understand how wills and trusts work, and we share lots of valuable information with you. If you come to a workshop, we also offer you a free consultation. This is when we do some goal-setting, and we help you create an Estate Plan that is right for you. We look forward to meeting you!