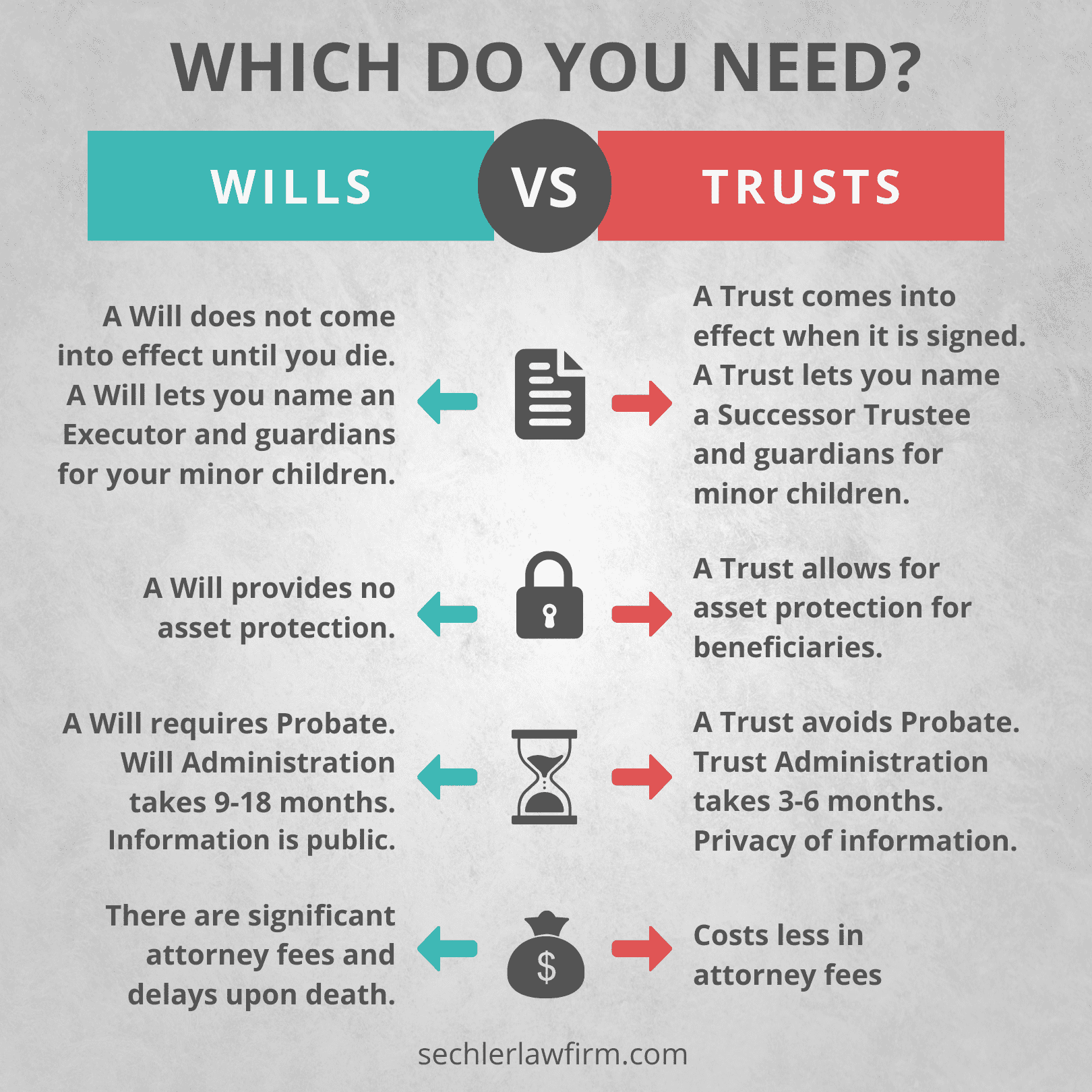

A common question Estate Planning clients ask is ‘Do I need a Will or a Trust?’

Wills and Trusts are both effective planning tools. Once we have ascertained what needs to be accomplished, we will determine which tool is appropriate for you. The first thing to consider is how you own your assets – whether individually or jointly. If your assets are beneficiary designated, it may affect your wishes outlined in your Will. Couples often own their home jointly, so when one spouse passes, the remaining spouse retains the house. Upon death, beneficiary designated assets become the property of the beneficiary. This is because beneficiary designations typically supersede the Will. Unfortunately, this means that if the beneficiary developed a disability, inheriting the money may cause them to lose their benefits. In addition, if the beneficiary has a contentious spouse, the inheritance can be lost in a divorce.

What is a Will?

If you own your assets individually, they are transferred via your Will, and would be in your estate after you pass away. A Will is a set of instructions governing how your estate is administered after you pass away. Your Executor’s responsibility is to facilitate the terms of your Will, which goes through probate. Many financial advisors will advise putting beneficiary designations on everything, to avoid probate. Unfortunately, people assume that if they have beneficiary designations, a Will is unnecessary. Beneficiary designations only answer the question of who gets your stuff when you pass away. Conversely, Wills address complicated scenarios regarding disabilities, divorce, addiction, or if one of your beneficiaries passes away before you do. Wills take into account not only who gets your stuff, but also the circumstances under which the distribution of your assets are made.

What is Probate?

Probate is a court process that is overseen by a judge, and may take a year or more to complete. The executor files an inheritance tax return and will often involve a lawyer in the process. The lawyer may advise the executor to delay the process of finalising probate, to allow for creditors who have 12 months to claim money owing to them, from your estate. Thereafter, the estate is settled with a signed agreement. Finally, any remaining funds are distributed according to your Will.

Using a Trust

When doing estate planning to avoid probate, it is advisable to use a Trust which is like a company, where you own it and you are in control of it. You also make decisions about how to do things. In turn, the company owns the stuff like the furniture and equipment, and any other assets relating to the company. A trust is the same concept, but it is a document. When the trust is signed, it is a new legal entity, and assets are put into the trust. The Trustee is the person in control of the Trust, and the beneficiaries are the people who have access to the Trust. The person who creates the Trust is the Grantor.

Who Does What in a Trust?

Sometimes, the same person is the Grantor, Trustee and Beneficiary, in the case of a Revocable Trust. The grantor has control and can access the assets in the trust. After you pass away, the assets are subject to the trust agreement, and it trust stipulates who gets what. Additionally, the trust resolves issues relating to a disabled beneficiary, or a divorce case, regarding distributions. While a Will and Trust both designate your wishes and your assets, the trust handles the matter privately, without the need for a judge or court. Moreover, a Trust is administered privately with family members, saving time and money. Revocable trusts are a great tool if you are wanting to retain control of your assets.

What Trust is Right for Me?

An Irrevocable Trust takes control of the assets from the Grantor, thus protecting them from third parties. There are different types of Irrevocable Trusts, but we will focus on the Asset Protection Trust.

While traditional estate planning focuses on death planning, it is important to have a legal plan in place, to enjoy your retirement. You have likely worked hard for many years, and have saved up for a financial nest egg, with plans to travel with your spouse once you retire. Unfortunately, things can sometimes get in the way. If your spouse gets sick, and they need care in a nursing home, this could negatively impact your finances. Nursing home care costs more than $180,000 per year, and this is an expense not many people can afford.

Sechler Law Firm works with families to protect their assets from long term care expenses. If long term care costs are a concern for you, an Asset Protection Trust is the answer. In this case, the Grantor maintains certain levels of control. They also decide who the beneficiaries are, and how to invest. However, the grantor must relinquish their access to the assets. Bear in mind that if the Grantor has access, the nursing home will also have access to the trust, which we would rather avoid. The beneficiaries can access funds on the grantor’s behalf if necessary.

Come to a Workshop

To learn more about Wills and Trusts, please come to one of our workshops. A workshop is as great place to start, to understand how estate planning works and get the basic information you need. We offer free consultations after the workshop, to establish how we can help you. Visit sechlerlawfirm.com/workshops to register for one of our upcoming workshops.

Here is a short video which may help you too….